WORK IN PROGRESS

I’ve built my fair share of DCFs and LBOs in the last few months of banking. Really on the job, it’s just plugging numbers into an excel which then outputs some answer you export onto PowerPoint. But thought it would be helpful to learn how to model out SaaS economics.

Revenue Model

Three things really matter here:

- Acquiring Customers

- Retaining Customers

- Monetizing Customers

Using these three concepts as drivers in the revenue build, especially in these early-stage SaaS companies, the intuition becomes a lot more concrete.

Step 1: Forecast New Customers

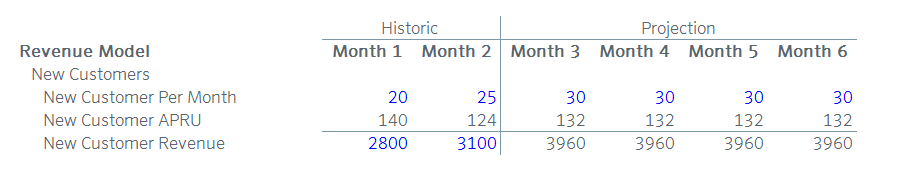

- Take the historic numbers of new customers and new revenue to find Average Revenue Per User (“APRU”). APRU becomes a driver in our future forecast. This should roughly look like this:

Note: Blue cells are hard coded. Assuming historically, 20-25 new customers per month, to grow to 30 in Month 3 – Month 6. Assuming $2800 revenue from new customers in Month 1 and $3100 in Month 2, to back out $140 in APRU, and $124 in APRU respectively. Taking the average of the two months’ APRUs, I’m left with $132 in APRU for Months 3 – Month 6.

Step 2: Forecast Churn

- Take historic churn number to find the % historic churn each month (Churn / Total Customers)

- Find Churn APRU by dividing Total Churn / Customers Churned

- Project forward using average Churn % multiplied by Total Customers, which is a function of last month’s customers + new customers – churned customers

- Take average of historic APRU and multiply by customers churned to get Total Churned Revenue (loss)

Step 3: Forecast Expansion